Net Asset Value : This is per share amount of total fund's value. To calculate the NAV first add current market values of all assets and divide it by the number of shares. In stocks prices change in every second but NAV is calculated in a daily basis.

Open Ended Scheme : In open ended scheme any time during the scheme period an investor can enter or exit the scheme by buying or selling at its present Net Asset Value (NAV).

Close Ended Scheme : In this scheme a fixed number of shares are sold during its initial public offer(IPO) and later the buying and selling or shares are possible only in secondary market.

Equity Funds : Mutual funds invest in stock market are called equity funds or stock funds. Equity funds can again divided in to many categories

Growth Funds : In this funds will be invested in companies with high growth potential for a long term capital appreciation. Growth funds are more volatile to market risks.

Income Funds : Invest in companies with high dividend payouts providing safety and regular income.

Blend Funds : It is a mixture of Growth and Income funds to provide long term capital appreciation and current income. By risk-wise it is in between growth funds and income funds

Small-Cap, Mid-Cap and Large-Cap Funds : In stock market companies are divided in to many groups according to their market capitalization like large-cap, mid-cap and small-cap companies. Market Capitalization is one way of measuring the size of the company and is decided by the number of shares in the market and value per share. Mutual funds are also categorized like this based on the share they hold.

Equity Linked Saving Schems ELSS : This is equity linked saving schemes. It is a kind of diversified mutual fund in which fund manager invest in varies companies from varies industry so risk factor is low. Also in India there is a tax benefit in investing ELSS. These funds have a lock in period of three years but the return is better and plus you will get tax benefits.

There are many other types of mutual funds like money market funds, Leveraged Funds, Index Funds, Hedge Funds, Sector Funds, Specialized Funds etc

Mutual Fund Companies in India

Birla Sun Life Mutual Fund

HDFC Mutual Fund

HSBC Mutual Fund

Prudential ICICI Mutual Fund

Sahara Mutual Fund

State Bank of India Mutual Fund

Tata Mutual Fund

Kotak Mahindra Mutual Fund

Reliance Mutual Fund

Standard Chartered Mutual Fund

Franklin Templeton India Mutual Fund

Morgan Stanley Mutual Fund India

Canbank Mutual Fund

LIC Mutual Fund

GIC Mutual Fund

Bramayugam

Bramayugam Thundu

Thundu Manjummel Boys

Manjummel Boys Thalavan

Thalavan Neru

Neru Vivekanandan Viralaanu

Vivekanandan Viralaanu Kudumbasthreeyum Kunjadum

Kudumbasthreeyum Kunjadum Varshangalkku Shesham

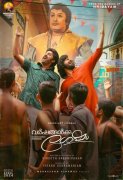

Varshangalkku Shesham