ABN AMRO Bank

ABN AMRO Bank was a Dutch bank that operated globally, including in India. Here is an overview of its history, profile, and financials:

History:

ABN AMRO Bank was formed in 1991 through the merger of two Dutch banks, Algemene Bank Nederland and AMRO Bank. The bank expanded globally and had a presence in more than 50 countries, including India. In 2007, a consortium of banks, including Royal Bank of Scotland, acquired ABN AMRO Bank. The consortium subsequently split up ABN AMRO Bank, with various parts of the bank being acquired by different banks.

Profile:

ABN AMRO Bank offered a range of banking and financial services to customers in India, including savings accounts, current accounts, fixed deposits, loans, credit cards, debit cards, and online banking services. It also provided investment banking services and asset management services to corporate clients.

Financials:

ABN AMRO Bank reported a net profit of EUR 4.4 billion (approx. USD 5.2 billion) for the year 2006. Its total assets as of December 31, 2006, stood at EUR 989 billion (approx. USD 1.17 trillion). It is important to note that these figures are for the global operations of the bank and not specifically for its operations in India.

Following the acquisition of ABN AMRO Bank, its operations in India were acquired by RBS and subsequently by RBL Bank.

ABN AMRO Bank offers a suite of products for your personal financial needs offered through various channels including ATMs, Doorstep Banking and NetBanking.

ABN AMRO (India) has branches in Bangalore, Baroda, Chennai, Delhi, Gurgaon, Hyderabad, Kolkata, Lucknow, Mangalore, Moradabad, Mumbai, Noida, Panipat, Pune, Surat and Tirupur with each branch servicing multi-product relationships.

Web : http://www.rbs.in/

Bramayugam

Bramayugam Thundu

Thundu Manjummel Boys

Manjummel Boys Thalavan

Thalavan Neru

Neru Vivekanandan Viralaanu

Vivekanandan Viralaanu Kudumbasthreeyum Kunjadum

Kudumbasthreeyum Kunjadum Varshangalkku Shesham

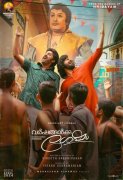

Varshangalkku Shesham